QUALIFYING CHARITABLE ORGANIZATIONS

This individual income tax credit is available for contributions to Qualifying Charitable Organizations (QCO). SOUNDS Academy is a Qualifying Charitable Organization.

Maximum Credit for 2025:

-Married filing jointly: $987 (Qualifying Charitable Organization)

-Single or head of household: $495 (Qualifying Charitable Organization)

Donation Deadline: April 15 (for previous tax year)

Form to File

Credit/Deduction Distinctions

Any charitable contribution that is included in itemized deductions on your federal return must be removed from your Arizona itemized deductions if the contributions were claimed as an Arizona credit. Donations made to organizations not listed on the department’s published website are typically allowable as deductions. You cannot claim both a deduction and a credit for the same charitable contribution on your Arizona return.

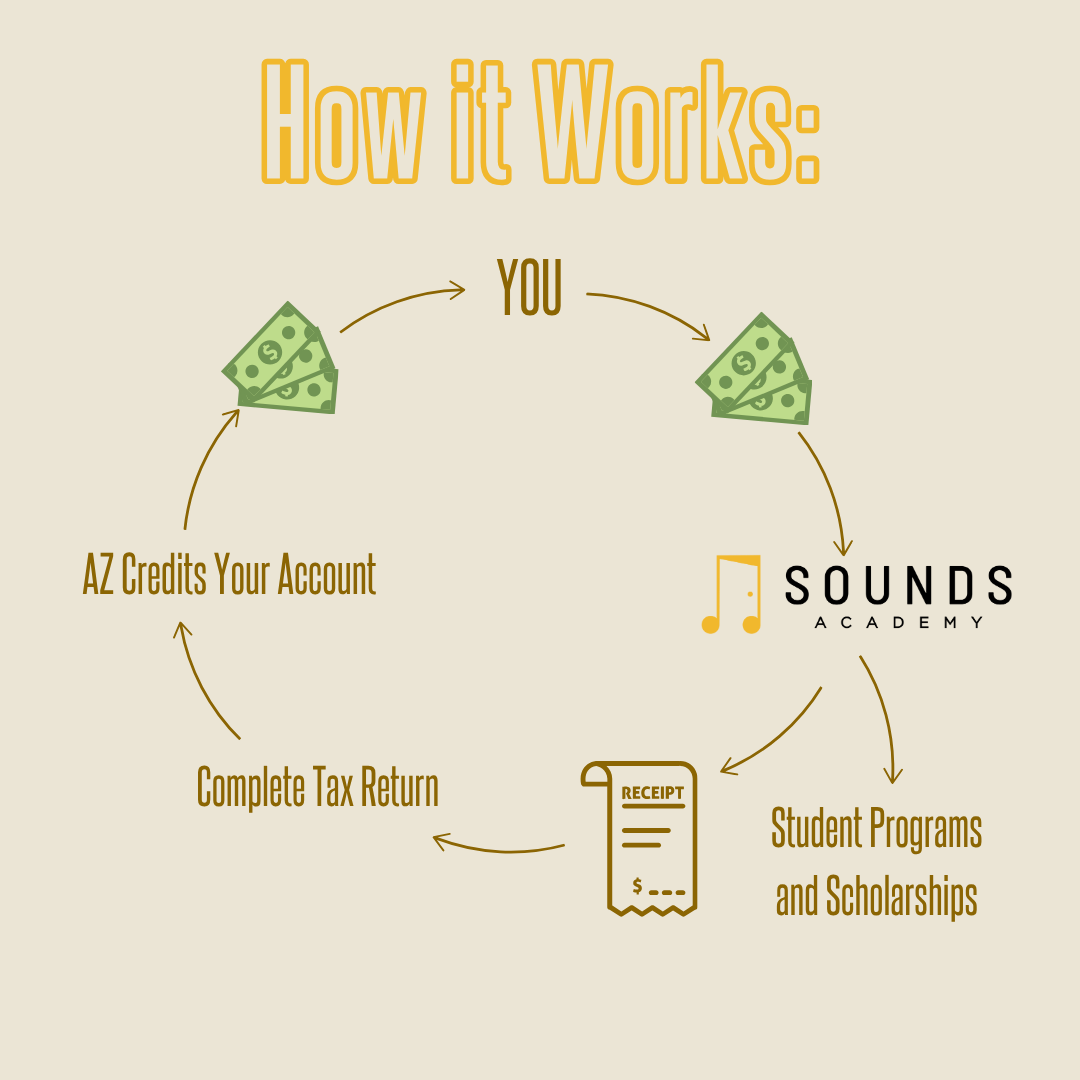

1. You make a financial donation to SOUNDS Academy

2. SOUNDS Academy uses the money for student programming and scholarships

3. SOUNDS Academy sends you a letter of acknowledgement

4. When completing your taxes, you mention that you donated to a Qualifying Charitable Organization (SOUNDS Academy!) *

5. Submit your taxes

6. Arizona Credits your taxes

7. Repeat

*SOUNDS Academy and our representatives are not attorneys, tax advisors, or financial advisors. You should consult with your tax advisor to receive recommendations on your specific situation.

FAQ's

Q: How do I make my donation?

A: You can make your Qualifying Charitable Organization (QCO) donation by clicking HERE. After making a donation, you will receive an acknowledgment letter from SOUNDS Academy.

Q: How can I claim my tax credit?

A: First and foremost, you should consult your tax advisor. On Form 321 you will report “SOUNDS Academy” and the dollar amount which you donated. You must also total your nonrefundable individual tax credits on Form 301 and include all applicable forms when you file your tax return. Remember to consult your tax advisor.

Q: How much can an individual claim for the credit for contributions to Qualifying Charitable Organizations(QCO)?

A: An individual can claim up to $495 in credit on their state taxes. A married couple filing together can claim up t0 $987.

Q: If I give my tax credit to SOUNDS Academy, can I still give my credit to a school?

A: Yes. Donating to SOUNDS Academy (a qualifying charitable organization (QCO)) does not conflict with donating to a public school (a public school tax credit). A QCO can be credited up to $495 ($987 per married couple) while a public school can be credited up to $200 ($400 per married couple). Therefore an individual could donate to both and received both tax credits.

More Information for Taxpayers

- Click HERE for more information on Credit for Contributions to Qualifying Charitable Organizations

*SOUNDS Academy and our representatives are not attorneys, tax advisors, or financial advisors. You should consult with your tax advisor to receive recommendations on your specific situation.